Optimize Your Tax Obligation Deductions With a Simple and Efficient Mileage Tracker

In the realm of tax obligation reductions, tracking your gas mileage can be an often-overlooked yet critical task for maximizing your economic advantages. A well-kept mileage log not only ensures conformity with internal revenue service demands but additionally boosts your capability to validate business expenses. Picking the ideal mileage monitoring device is vital, as it can simplify the procedure and enhance accuracy. Nonetheless, lots of individuals fall short to totally leverage this opportunity, bring about prospective shed financial savings. Comprehending the nuances of reliable mileage monitoring may disclose techniques that can considerably influence your tax scenario.

Value of Gas Mileage Tracking

Tracking gas mileage is crucial for anyone seeking to maximize their tax obligation reductions. Exact gas mileage monitoring not just ensures compliance with IRS regulations but also allows taxpayers to benefit from deductions connected to business-related traveling. For freelance people and company owner, these reductions can dramatically lower taxed revenue, therefore decreasing general tax obligation.

Additionally, maintaining a comprehensive record of gas mileage aids compare personal and business-related trips, which is essential for confirming cases throughout tax audits. The IRS calls for certain paperwork, including the day, location, purpose, and miles driven for each trip. Without thorough records, taxpayers risk shedding useful deductions or facing fines.

Furthermore, effective gas mileage monitoring can highlight fads in traveling expenses, aiding in much better financial preparation. By evaluating these patterns, people and services can identify possibilities to enhance traveling paths, reduce expenses, and enhance functional efficiency.

Picking the Right Mileage Tracker

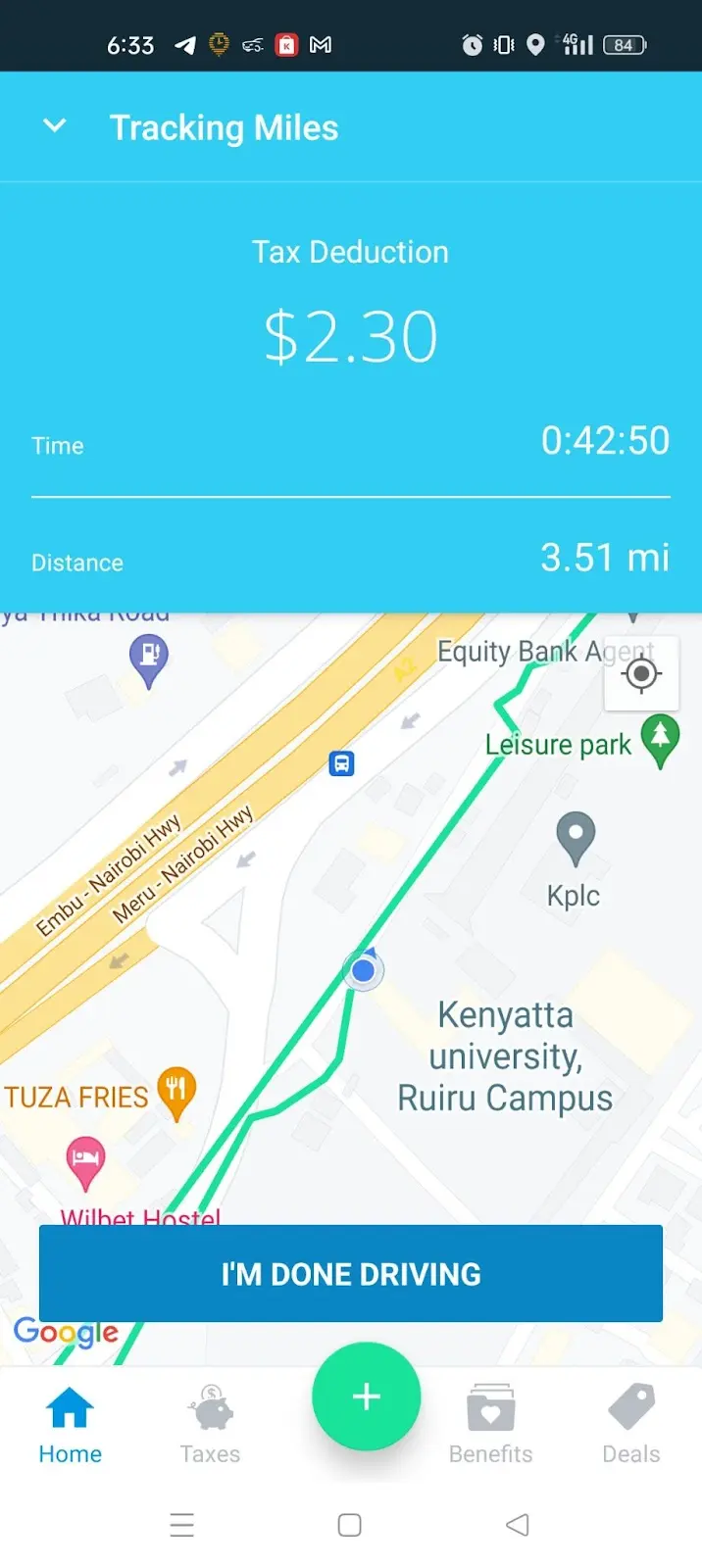

When picking a mileage tracker, it is crucial to think about various functions and functionalities that line up with your details requirements (best mileage tracker app). The initial aspect to examine is the method of tracking-- whether you favor a mobile app, a general practitioner device, or a hands-on log. Mobile applications often supply convenience and real-time tracking, while general practitioner tools can provide even more precision in distance measurements

Following, analyze the integration abilities of the tracker. An excellent mileage tracker ought to flawlessly incorporate with bookkeeping software program or tax obligation preparation tools, permitting straightforward data transfer and coverage. Look for attributes such as automated tracking, which lessens the demand for manual entries, and categorization choices to identify in between organization and personal trips.

Exactly How to Track Your Gas Mileage

Choosing an ideal gas mileage tracker establishes the structure for effective mileage management. To accurately track your mileage, begin by identifying the function of your journeys, whether they are for company, charitable activities, or medical reasons. This clarity will help you categorize your journeys and guarantee you record all pertinent information.

Following, continually log your gas mileage. For hands-on entries, document the beginning and ending odometer readings, along with the day, objective, and path of each trip.

It's also essential to routinely review your entries for precision and completeness. Establish a timetable, such as once a week or regular monthly, to consolidate your documents. This method helps protect against discrepancies and ensures you do not overlook any kind of deductible gas mileage.

Finally, back up your records. Whether electronic or paper-based, maintaining back-ups safeguards versus data loss and facilitates simple access throughout tax prep work. By diligently tracking your gas mileage and maintaining arranged records, you will lay the foundation for optimizing your potential tax reductions.

Making Best Use Of Deductions With Accurate Records

Accurate record-keeping is important for optimizing your tax obligation deductions related to mileage. When you preserve thorough and precise records of your business-related driving, you produce a robust structure for asserting reductions that might significantly lower your taxable earnings.

Using a gas mileage tracker can simplify this procedure, enabling you to log your journeys easily. Several applications automatically determine distances click and categorize trips, saving you time and minimizing mistakes. Furthermore, maintaining sustaining paperwork, such as invoices for associated costs, enhances your situation for deductions.

It's essential to be regular in taping your mileage. Ultimately, exact and orderly mileage documents are essential to optimizing your deductions, guaranteeing you take complete advantage of the possible tax advantages offered to you as a business vehicle driver.

Common Mistakes to Stay Clear Of

Preserving precise records is a substantial step toward making the most of gas mileage reductions, but it's just as crucial to be familiar with common errors that can undermine these initiatives. One common error is falling short to document all journeys precisely. Also small business-related journeys can accumulate, so overlooking to videotape them can cause substantial shed deductions.

An additional mistake is not differentiating in between personal and service mileage. Clear classification is essential; blending these two hop over to here can activate audits and lead to charges. Additionally, some individuals neglect to keep sustaining documents, such as invoices for relevant costs, which can better validate cases.

Inconsistent tracking approaches also present an obstacle. Relying upon memory or occasional log entries can lead to errors. Using a mileage tracker application ensures constant and trusted records (best mileage tracker app). Finally, forgeting IRS guidelines can endanger your cases. Familiarize yourself with the most recent regulations concerning have a peek at this website mileage deductions to avoid unintentional errors.

Final Thought

Finally, efficient gas mileage tracking is necessary for maximizing tax reductions. Making use of a trusted gas mileage tracker streamlines the procedure of taping business-related trips, making certain exact documents. Normal testimonials and back-ups of mileage records boost conformity with internal revenue service guidelines while supporting informed economic decision-making. By staying clear of typical risks and maintaining meticulous documents, taxpayers can considerably decrease their overall tax responsibility, eventually benefiting their financial wellness. Carrying out these methods fosters an aggressive technique to managing overhead.

Comments on “Track Your Expenses with Precision Using the Best Mileage Tracker App for Simple Mileage Logs”